Forth Ports is BTOM Ready

Border Control Requirements

The UK Government published its final Border Target Operating Model (BTOM) in August 2023 which aims to balance the need for effective border controls with import processes that are as simple as possible.

The BTOM was progressively introduced from 31 January 2024 and it applies to imports from all countries into GB, including the EU:

Sanitary and Phytosanitary controls (imports of live animals, germinal products, animal products, plants and plant products)

For Sanitary and Phytosanitary controls, the BTOM has three elements:

- Global risk-based approach – products will be categorised as high, medium or low risk, with controls appropriately weighted against the risks posed both by the commodity and the country of origin

- Simplified and digitised health certificates

- Simplification of border controls – may be eligible for facilitations to make importing easier

Safety and Security controls (all imports)

The BTOM will minimise trader burdens and maintain border security while remaining aligned with international standards through:

- Reduced Safety and Security data requirements

- Easier to submit Safety and Security data through a UK single Trade Window

- Remove duplication of data

The BTOM is part of the Government’s broader approach to its Border 2025 strategy, with the principle of the UK’s border becoming one of the most effective in the world through Single Trade Window, Ecosystem of Trust and Trusted Trader Schemes.

Implementation of the BTOM in three phases

Phase 1: 31 January 2024

- Introduction of health certification on imports of medium risk animal products, plants, plant products and high risk food and feed of non-animal origin from the EU.

- Removal of pre-notification requirements for low risk plant and plant products from the EU.

Phase 2: 30 April 2024

- Introduction of documentary and risk-based identity and physical checks on medium risk animal products, plants, plant products and high risk food and feed of non-animal origin from the EU.

- Existing inspections of high risk plants/plant products from the EU will move from destination to Border Control Posts

- Simplification of imports from non-EU countries which will include, the removal of health certification and routine checks on low risk animal products, plants, plant products as well as reduction in physical and identity check levels on medium-risk animal products

Phase 3: 31 October 2024

- Requirement for Safety and Security declarations for EU imports or from other territories where it was previously exempt.

- Reduced dataset for Safety and Security declarations and use of UK Single Trade Window to remove duplication.

BTOM Ready: Keep the flow

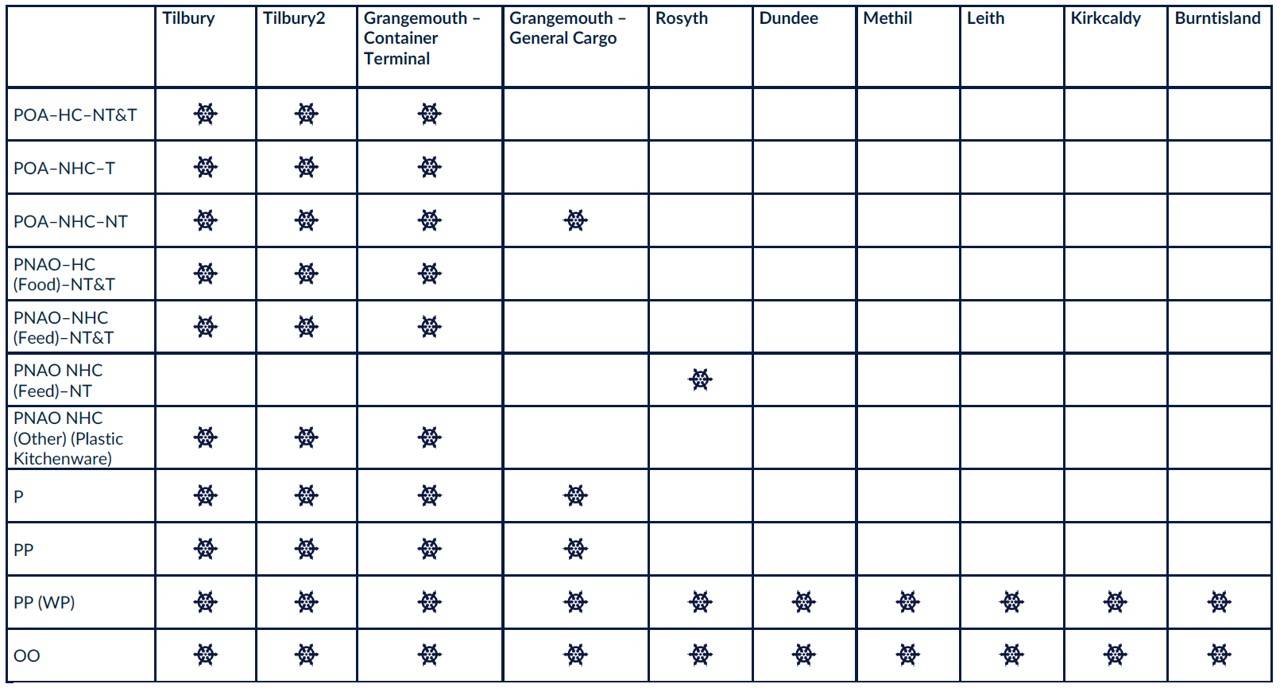

Forth Ports was the first multi-purpose port group to obtain Authorised Economic Operator (AEO) status and has worked closely with government departments, local authorities, agencies and industry to prepare for the changes in trading arrangements.

Forth Ports already has extensive experience in handling non-EU goods – as such all our ports have existing Temporary Storage approvals and I.T. systems in place to handle goods subject to Customs and border controls. All international cargo handled is inventory linked via Destin 8 with LCT being linked to both Destin 8 and CNS. At Tilbury 2 the port approval allows goods to be moved under temporary storage by Destin 8 or Goods Vehicle Movement Service (GVMS).

Click here to view a summary of the inventory linked systems at Forth Ports facilities in the UK.

Forth Ports has worked with the Government to deliver enhanced and new BCPs at our facilities. LCT’s BCP is already fully designated, Grangemouth’s BCP has recently received it’s designation for both the Container Terminal and General cargo, and Tilbury 2’s BCP was fully designated by 30 April 2024.

Trade preparation – BTOM Ready for Sanitary and Phytosanitary border controls

BTOM Sanitary and Phytosanitary border controls came into effect from 31 January 2024 for imports of animal, animal products, plants and plant products into GB from the EU and non-EU countries.

Under the BTOM, commodities will be categorised as high, medium or low risk. Queries on risk category can be emailed Animal and Plant Health Agency (APHA) imports: imports@apha.gov.uk

The border controls are based on data about regulated goods, which enables the targeting of more intensive checks, the assurance of official certification, and physical inspection through:

- Pre-notification of arrivals into GB using Import of Products, Animals, Food and Feed system (IPAFFS)

- Health certificates

- Checks at Border Control Post (BCP)

To check the requirements, from this date and from 30 April 2024, click below to read more.

Key Contacts

Derek Robertson

Group Customs Manager

Head Office

1 Prince of Wales Dock

Edinburgh

EH6 7DX

+44 (0) 131 555 8746

Glossary

Authorised Economic Operator (AEO) – An internationally recognised quality mark that provides quicker access to some simplified Customs procedures and, in some cases, the right to fast-track shipments through some Customs and safety and security procedures.

Border Control Posts (BCPs) – A BCP is an inspection post designated and approved to carry out documentary, identification and physical checks on commodities arriving at the GB border in order to protect UK biosecurity. The levels of checks is typically determined by the commodities risk category. From 30 April 2024, infrastructure will be needed to meet the further requirements of full border controls on EU goods, including Customs compliance checks and SPS checks which will need to be carried out at BCPs. For more information on BCPs

Border Target Operating Model – The government issued document which sets out the new processes for importing and exporting Animal and Plant products under the Sanitary and Phyto-Sanitary guidelines, available here: (The Border Target Operating Model: August 2023 – GOV.UK (www.gov.uk).

Commodity Code – All goods being imported and exported shall need a commodity code. Please see here.

Controlled goods – Traders moving controlled goods must submit a Full Customs declaration (or use Simplified Customs declaration procedures if they are authorised to do so); they must ensure that any specific licensing requirements are fulfilled. The list of controlled goods is available here. Under BTOM goods subject to SPS control are considered controlled goods.

Simplified Customs Declaration Procedure (SCDP) – An HMRC authorised procedure that allows a Simplified Frontier declaration to be submitted to HMRC at the time of import or export and allows the goods to flow through port. A Supplementary declaration requires to be submitted by the 4th day of the month (changing to 10th day of the month in May 2024) following the date of import.

Full Declaration – These are required to be submitted unless authorised by HMRC for Simplified declarations under SCDP.

Goods Vehicle Movement System (GVMS) – A port approval and I.T. platform which supports the Pre-Lodgement model. The GVMS will allow: declaration references to be linked together so that the person moving the goods (e.g. a haulier) only has to present one single reference (Goods Movement Reference or GMR) at the frontier; the linking of the movement of the goods to declarations, enabling the automatic arrival in HMRC systems as soon as goods board vessels so that declarations can be processed en route and notification of the risking outcome of declarations in HMRC systems can be sent to the person in control of the goods by the time they physically arrive in UK ports.

Health Certificates – A Health Certificate or Export Health Certificate (EHC) is an official document that contains information that identifies the consignment and is issued by authorised officials in exporting countries to certify that the goods meet certain health standard and regulations to allow the commodity to be imported into GB. If a health certificate does not exist for the goods to be imported, an import licence or authorisation may be required. Animal and Plant Health Agency (APHA) Animal Imports team can be contacted for queries.

Import of Products, Animals, Food and Feed system (IPAFFS) – Is the UK government system that pre-notification of relevant SPS goods are made within by the person responsible for consignment being imported and must be a UK entity with physical address.

HMG Her Majesty’s Government – the government of the UK.

Pre-lodgement – An alternative for ports that may not have the space and infrastructure to operate Temporary Storage. Border locations receiving goods that are moving into the UK from the EU will be able to choose to use a Pre-Lodgement model, where goods arriving will be required to have submitted a Customs declaration in advance of boarding on the EU side.

Phytosanitary Certificate (PC) – A physical paper certificate from an exporting country’s competent authority that shows that that plant or plant product has been officially inspected and meets the import requirements for GB. Information about phytosanitary certificate.

Sanitary and phytosanitary (SPS) – Measures to protect humans, animals, and plants from diseases, pests, or contaminants. There is a detailed set of rules to reduce or eliminate the possible risks of animal, plant and public health threats as well as animal and plant diseases being introduced into country by imported goods.

Temporary Storage – When goods imported from outside the UK are temporarily stored for up to 90 days under Customs control before they are placed under a special procedure, released to free circulation or exported outside the UK. Any goods not customs cleared within 90 days can be seized by HMRC or Border Force.